SUPPORT AND SERVICES

Technology support, compliance support, asset support and eco-support are the main pillars that are indispensable on the way to a win-win situation

Technical Support

One-stop turnkey T2B2C solution

Compliance Support

3W AIFO Innovative Compliance Solutions

Asset Support

"Connect + Distribute"

Ecosystem Support

Ecosystem as a Service

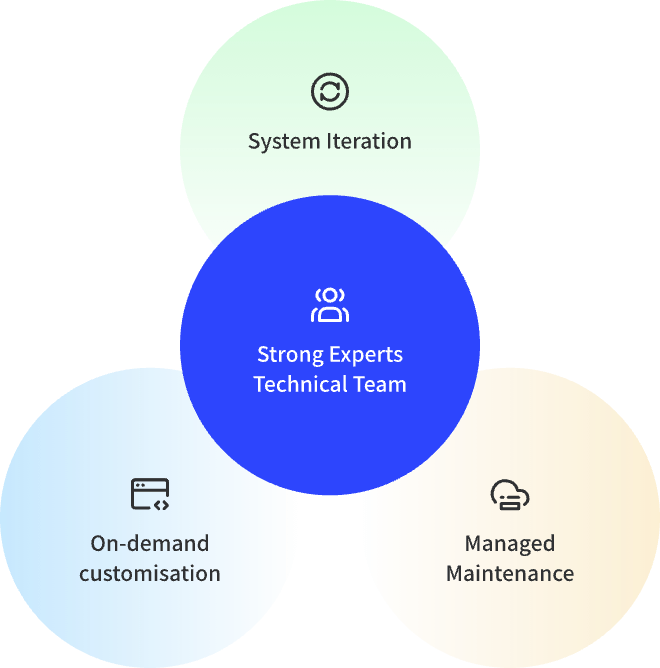

TECHNICAL SUPPORT:ONE-STOP TURNKEY T2B2C SOLUTION

Create the perfect brand for your B-Side financial partners with our all-in-one fintech solution

System upgrades and iterations

Our cross-regional, interdisciplinary team of hundreds of scientific and technological research and development team, will always maintain the system maintenance and upgrading, optimising the underlying system and enriching the product features so that we can use the assured, comfortable to use!

On-demand custom development

For home office teams with individual needs, we can send a dedicated product and technical team to help them sort out design features and develop them for use on the ground.

Hosting Operations and Maintenance

For the temporary lack of conditions or do not want to trouble the home office partners, we can provide system hosting operation and maintenance services to reduce the partner's personnel, operations and other management costs.

COMPLIANCE SUPPORT:3W AIFO INNOVATIVE COMPLIANCE SOLUTIONS

3W AIFO helps family offices to create and maintain appropriate trust structures globally using the latest financial technology, based on the offshore trust law system, with the trust super account as the core, and to combine it with other financial transaction licences around the world, to create a one-account solution for international financial transactions. As the world's first integrated solution provider to combine trust legal relationships with full asset management, it has greatly expanded the breadth and depth of its financial trading platform. Under common law regulation, all services of the "Web2+Web3" globalised trust asset management platform are safe and legal.

Trusts, as a versatile financial license, offer unique advantages in wealth preservation, appreciation, and inheritance through their integrated structure. They provide institutional benefits such as property independence, risk isolation, flexibility, and structural stability. Additionally, trusts serve dual roles in property management and transfer, accommodating various assets beyond monetary funds, including equity, real estate, and chattels, to meet diverse client needs.

Advantages of the innovative compliance solution introduced by 3W AIFO:

•Diversity of Trust Purposes

•Diversity of trust assets

•Diversity of instruments and directions

•Flexibility in management and utilisation arrangements

•Long-term duration of the trust and continuity of management

•Integration and integration of various functions to provide financial solutions

Trust Architecture Functions

Trust Asset Management Core Strengths

![]() Manage global funds and multiple asset classes in a single account

Manage global funds and multiple asset classes in a single account

![]() Flexible transaction structure EAM or autonomous management

Flexible transaction structure EAM or autonomous management

![]() Wealth preservation and Inheritance

Wealth preservation and Inheritance

![]() Tax planning

Tax planning

![]() Risk segregation asset safety and security

Risk segregation asset safety and security

![]() Global asset visualisation management

Global asset visualisation management

ASSET SUPPORT:"CONNECT + DISTRIBUTE"

3W Exchange empowers global B-side financial partners to provide trading services for traditional and digital financial products through its unique ability to connect different assets around the world, and empowers global B-side financial partners to issue financial products on their own (e.g. synthetic assets, DeFi products, over-the-counter derivatives, etc.) in terms of system, compliance and business model.

Hybrid Finance (HyFi) Trading

+

Multi-asset allocation platform

Asset Link

Stock exchange/Broker

Futures exchange/Broker

Forex exchange/broker

OTC derivatives issuer

Insurance company/Broker

Liquidity provider

Digital currency exchange

Digital currency

derivatives exchange

......

•Transaction custody, clearing, valuation, risk control and operations;

•Asset portfolio reports/operational reports;

•Trading and execution of finance facilities, etc;

•Cash management;

•Other value-added services.

Asset Release

OTC derivatives issuance

Digital insurance issuance

Synthetic assets

Perpetual contract

DeFi products

Tokenisation

NFT issuance

Security token issuance

......

•Transaction custody, clearing, valuation, risk control and operations;

•Asset portfolio reports/operational reports;

•Other derivatives design and execution;

•Web3 Wallet/Smart Contracts;

•Other value-added services.

Ecosystem Support:Ecosystem as a Service

Through our extensive network of partners, we foster comprehensive collaborations and strategic alliances to drive business growth. We empower family offices to optimise operational efficiencies, cost savings and sustainable growth, enabling them to deliver exceptional services and experiences to their clients.

Government Relations Networking

Media Network

Banking Private Banking

Investment Banking Capital Banks

External Assets Management Organisations

Clubs/Law Firms

Quality Education Network