CORE PRODUCT

3W AIFO

3W AIFO Global Digital Intelligence AI Home Office System is an international trust account financial one-account based on the global trust law system, supported by the world's leading Internet, A1, big data Web3 and other technologies, and centred on the two core dimensions of fiduciary legal relationship and total asset management. 3WAIFO empowers the home office industry to a higher level by constantly iterating and upgrading each module.

All of our modules, functions and processes are designed with the family office in mind and are centred on helping it solve the complex problems it faces every day to better serve its clients and generate the best possible profit.

Digital Intelligent Trust Management System

The trust management system is based on the global trust law system, the core of the trust super account, based on the safe holding of trust property, integrating: trust account opening, property custody, KYC/AML, fund management, settlement, clearing, valuation, beneficiary rights and interests distribution, information disclosure, contract custody and other custodianship operation services.

Multi-currency Fusion Account System

Forward-looking creation of a super-converged account system integrating fiat currency accounts, digital asset accounts, centralised custodian accounts, decentralised Web3 accounts and credit card accounts; this account system can be connected to different scenarios to meet the complex service needs of home-based businesses.

Credit card issuance system based on trust assets

3W Card (Visa/Mastercard physical card) breaks the traditional banking framework by providing your clients with a one-stop global trust asset management system platform to access their trust account funds anywhere in the world where Visa/Mastercard is supported.

Global Multi-Asset Trading Platform

•Connects to 150+ exchanges in 30+ countries with 65,000+ trading varieties.

•Connects traditional finance (TradFi) with decentralised finance on the chain (DeFi)

AI Empowerment

•AI technology is fully applied to all aspects of the home office system, such as customer communication, risk assessment, data analysis, report generation, investment advice, etc.

•AI greatly improves the efficiency of the Family Office and helps it to provide more accurate and personalised services to customers

Web3 Empowerment

•Web3 Wallet builds the gateway to a fast, secure and seamless decentralised transaction experience

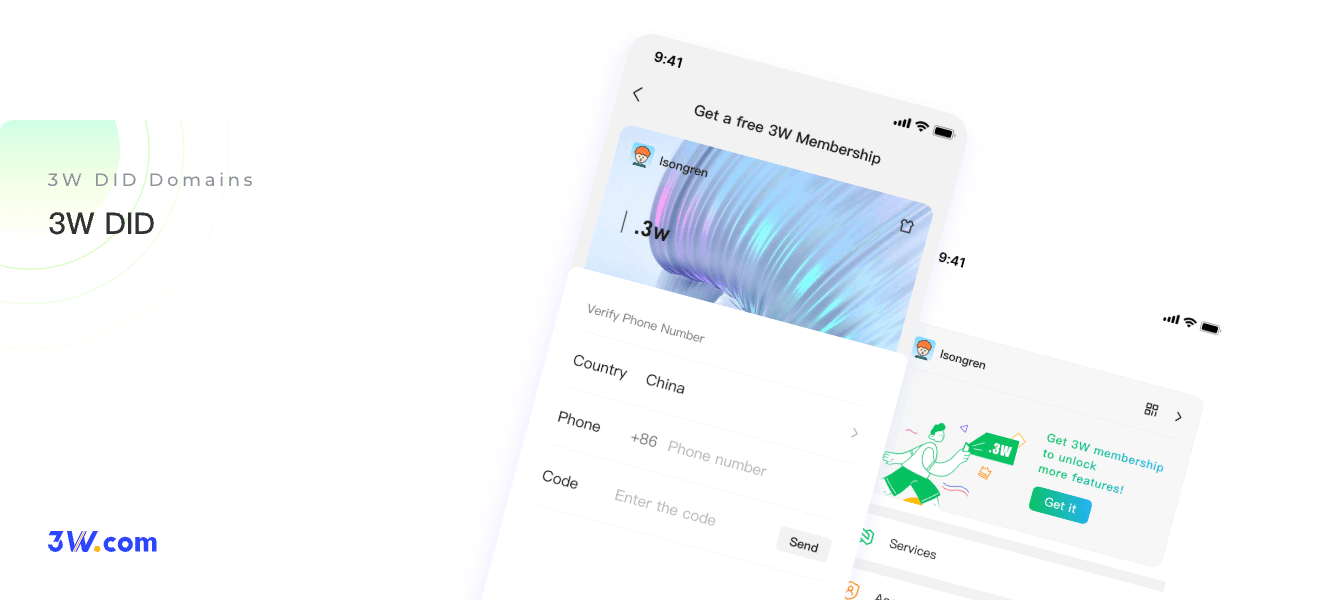

•Web3 Digital Identity is a new type of globally unique identifier that enables an entity (e.g., person, organisation, object, etc.) to be identified in a verifiable, persistent, and independent of centralised registries.

CORE - DIGITAL INTELLIGENT TRUST MANAGEMENT SYSTEM

3WAIFO Trust Digital Intelligent Management System is a trust asset management system based on the global trust law system and the core of trust super account, which focuses on the two core dimensions of trust legal relationship and full asset management, and creates one terminal to manage the investment transactions, asset allocation and risk control of multilevel accounts, and one account to cover the major financial products and markets in the world.

The main functions of 3W AIFO's digital trust asset management system include, but are not limited to: trust account opening, accounting for trust interests, valuation of trust property, regular disclosure of information, supervision of trust investment and fund receipt and payment, and distribution of trust benefits.

3W AIFO PLATFORM FUNCTIONALITY

Trust Account Opening|KYC|Customised Trust Plans|Online Trading and Multi-Asset Allocation|Trust Management

Equity Registration/Distribution|Information Disclosure

Object

Creating Reliance

Mainstay

International Trust Accounts

Financial Ledger

Trust

Services

![]() Global Asset

Global Asset

Allocation

![]() Account

Account

Services

![]() Multi-scenario

Multi-scenario

Connection

Offshore Trust Law Regime

![]() Financial Technology

Financial Technology

![]() Trusts

Trusts

![]() Insurances

Insurances

![]() Investment

Investment

Banking

![]() Assets

Assets

Management

![]() Payment

Payment

![]() Web3

Web3

3W AIFO SOLUTIONS

3W AIFO provides a trust management system solution for all family offices. The trust management system covers front, middle and back office trust operation support services, providing a comprehensive one-stop digital trust service for its end users.

Individual Standard Trust Account Service Experience

Trust Services:

•7*24 hour service

•Global asset custody

•C to B customised services

•Global access and transfer

•Trust-wide services

Features:

Fast account opening

- 5 min to open an account

Super Features

- A globally connected safe

Intelligent Experience

- One-stop management

Category:

•Family trusts

•Insurance trusts

•Charitable trusts

•Testamentary trusts

•Equity trusts

Business Coverage:

Trust formation consultancy

Trust administration

Agent services

Back-office management

Compliance services

Accounting & Reporting

Client service

One-Stop Internet Trust Service

8 Years +

8 Years +

Focus on trusts

5.6 Million

5.6 Million

Cumulative users

3 Systems

3 Systems

Service system

30 Billion

30 Billion

Total assets in custody

Full Service Closed Loop

•Risk assessment

•Trust account opening

•Customised trust plans

•Online vertical trading

•Express management trust content

•Separate use of principal and beneficiary accounts

External Asset Management (EAM)

EAM Service: Asset management entrusted to a third-party professional manager with the goal of achieving the highest possible benefits for the client.

Asset Manager

Signing of discretionary Entrustment agreement

Signing of external asset Management framework agreement

Clients

Trusts

ofassets and control of assets

CORE - MULTI-CURRENCY CONVERGED ACCOUNT SYSTEM

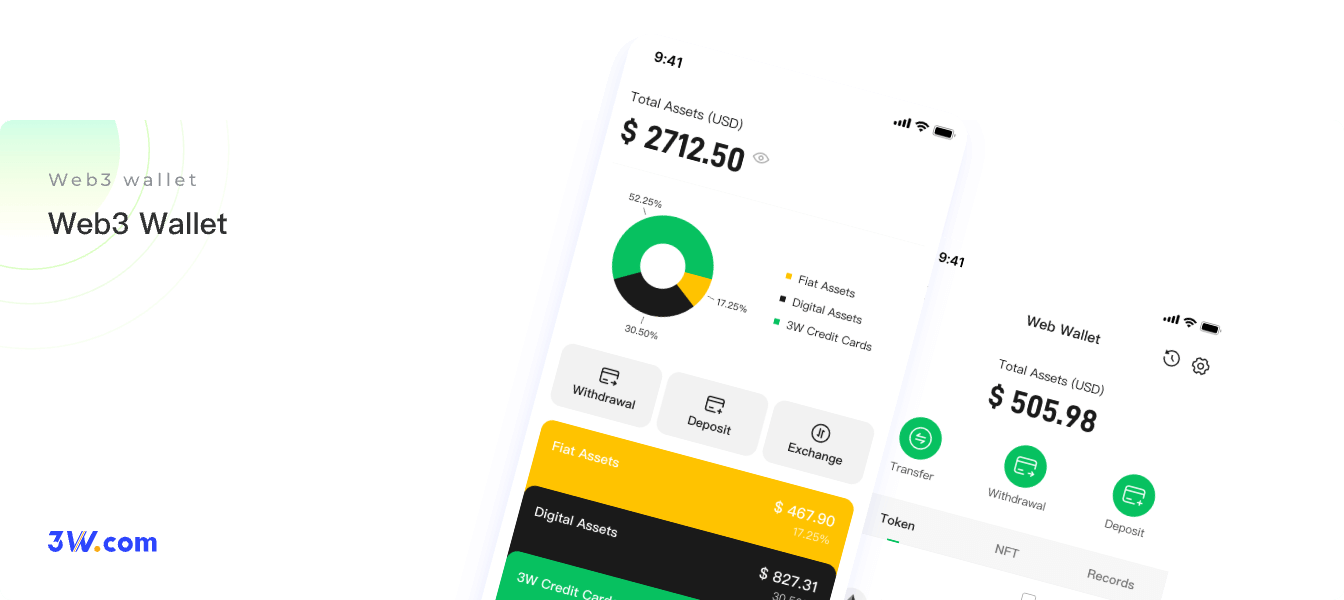

The customer account serves as the pivotal link between financial institutions and clients, directly addressing every financial need with appropriate products. 3W AIFO focuses on the super trust account, integrating Web3 smart contract wallets and virtual/physical cards to meet regulatory standards. This provides family offices with a flexible, scalable, and integrated account system. It ensures account and information security while innovatively catering to diverse mobile, contextual, and fragmented financial needs, boosting customer loyalty and upgrading business models and marketing strategies for future market competitiveness.

Trust Super Account (One Account)

Multi-level account

linkage management

![]() Account transaction

Account transaction

control

![]() Account limit

Account limit

control

![]() Transaction reconciliation

Transaction reconciliation

management

![]() Transaction clearing

Transaction clearing

management

Web2 Investment Account Module

Fiat currency account

Securities account

Futures account

Fund account

Insurance account

Digital currency

Web3 Smart Contract Wallet

Web3 World & DeFi Project Portal, Decentralised Identity (DID)...

Leveraging AI technology to support real-time settlement of multiple assets

Spending money can be settled in real time directly from cash, digital assets, stocks, and other investment products in your trust account, so you can enjoy worry-free spending.

Visa/Mastercard Virtual and Physical Cards

Trust-backed credit cards that give you the flexibility to use trust assets

Facilitate card repayment on the trust platform with different trust assets

Flexibility to use trust assets by withdrawing cash anytime, anywhere

Asset Conversion

Different accounts can transfer different currencies to each other and can also be converted to each other through the exchange function.

(including conversion between fiat currencies and digital assets).

EXTENSION - VISA/MASTER VIRTUAL/PHYSICAL CARD

Visa/Master virtual/physical cards - connecting the many features of the 3W AIFO system to a rich set of application scenarios, users can use their credit cards to spend fiat cash, cryptocurrencies, or other multi-asset directly at more than 90 million merchants around the globe, and anywhere Visa/Master cards are accepted. The card breaks the mould of traditional banking. The credit card breaks the traditional banking framework by providing a one-stop AIFO system platform with flexible access to all assets on a single card, helping customers manage multiple assets safely, flexibly and conveniently, allowing them to efficiently flow their funds and create exclusive financial services.

Hybrid Wallet System - Multiple Accounts

Hybrid Wallet System - Multiple Accounts

Flexible use of multiple assets

Convenient card repayment on hybrid financial trading platforms

A Global Reach

A Global Reach

Withdraw cash anytime, anywhere

Flexible access to multiple assets on a global hybrid financial trading platform

Pay With Peace Of Mind

Pay With Peace Of Mind

Industry-leading security features include:

2FA authentication, card freezes, password changes and more

Virtual Card/Physical Card - Functions

Global ATM Withdrawal

Global store consumption

Global online consumption

Global transfer card switching function

EXTENSION - GLOBAL MULTI-ASSET TRADING ALLOCATION

The global multi-asset trading platform integrates centralised finance (CeFi) and decentralised finance (DeFi) to provide global traders with a multi-market, multi-asset class global trust asset management platform, realising the "Web2 + Web3" trading, risk control and settlement management model (including: global equities, futures, options, bonds, funds, insurance, DeFi perpetual contracts, synthetic assets, etc.). (including: global stocks, futures, options, bonds, funds, insurance, DeFi perpetual contracts, synthetic assets, etc.). In the whole trading process, the efficient trade management system not only provides convenient operation experience, but also provides strong protection and control for the risk control of the whole trading.

Core Businesses

Product Features

Transaction

Transaction

OTC business: docking with broker trading system, realising multi-market trading and receiving quotes.

OTC business: import or interface to obtain OTC data and liquidity.

Web3 Business: Layer 2, Smart Contracts, Web3 Wallet...

Risk control

Risk control

Intraday Risk Monitoring: Pre-existing Risk Control, Mid-existing Risk Control, Post-existing Risk Control

OTC business: import or interface to obtain OTC data and liquidity

Intraday Risk Indicator Parameters: Compliance Risk Indicators, Management Risk Indicators

Settle

Settle

Multi-market fund account management, visual multi-asset unit management, asset unit dimensional settlement and issuance of settlement reports

Integration of multiple markets into one system for trading and settlement

Integration of multiple markets into one system for trading and settlement

Global: Connected to 30+ countries, 150+ exchanges and 65,000+ traded items worldwide.

Web2+Web3: the only product that provides a complete end-to-end Hybrid Finance (HyFi) solution for family office partners, connecting traditional finance (TradFi) and de-centralised finance (DeFi).

Powerful compliance and risk management features

Powerful compliance and risk management features

•Coverage of a full range of investment instruments, including global stocks, futures, options, bonds, funds, insurance and DeFi perpetual contracts, synthetic assets and other types of transactions.

•Compliance: account group self-transaction, large and frequent withdrawals, abnormal commission price, account position limit, single maximum order quantity limit function, support transaction workflow management.

•Risk control: before, during and after the management of products, custom account groups, funds accounts, sub-accounts, multi-level risk. Risk control can choose only warning or directly limit transactions.

•Support based on various types of management purposes of position allocation logic, to adapt to the requirements of various types of traders.

Invest globally with one account

Support various trading tools

stock

bond

fund

EFT

derivatives

futures

options

bank

insurance

digital currency

Europe

•BATS European Trading Platform BATS Europe (BATEDE)

•CHI-X Europe Ltd (Clearnet-CHI-X Europe Ltd)

•Frankfurt Stock Exchange

•London Stock Exchange

•SIX Swiss Exchange

•Madrid Stock Exchange (Bolsa de Madrid)

•Borsa Italiana

•......

America

•NYSE Archipelago (Arca-NYSE)

•ArcaEdge Trading System (ArcaEdge)

•BATS Exchange (BATS)

•Chicago Stock Exchange (CHX)

•Direct Edge Exchange (Direct Edge)

•Alpha Trading System (Alpha ATS)

•Aequitas NEO

•Mexican Stock Exchange

•IDEAL PRO trading system (IDEAL PRO)

•......

Asia Pacific

•Hong Kong Stock Exchange-SEHK

•HKEX Northbound Trading Connect-Shanghai-Hong Kong Stock Connect (SEHKNTL)

•Singapore Exchange

•Cboe Japan Ltd

•Korea Stock Exchange

•Australian Stock Exchange-ASX

•National Stock Exchange of India-NSE

•......

Innovation - AI Enablement

By adopting AI-powered solutions, family offices can increase operational efficiency, optimise investment strategies, reduce operating costs and provide a personalised client experience that differentiates them in the marketplace. From risk management to portfolio optimisation, AI will transform every aspect of the family office ecosystem.

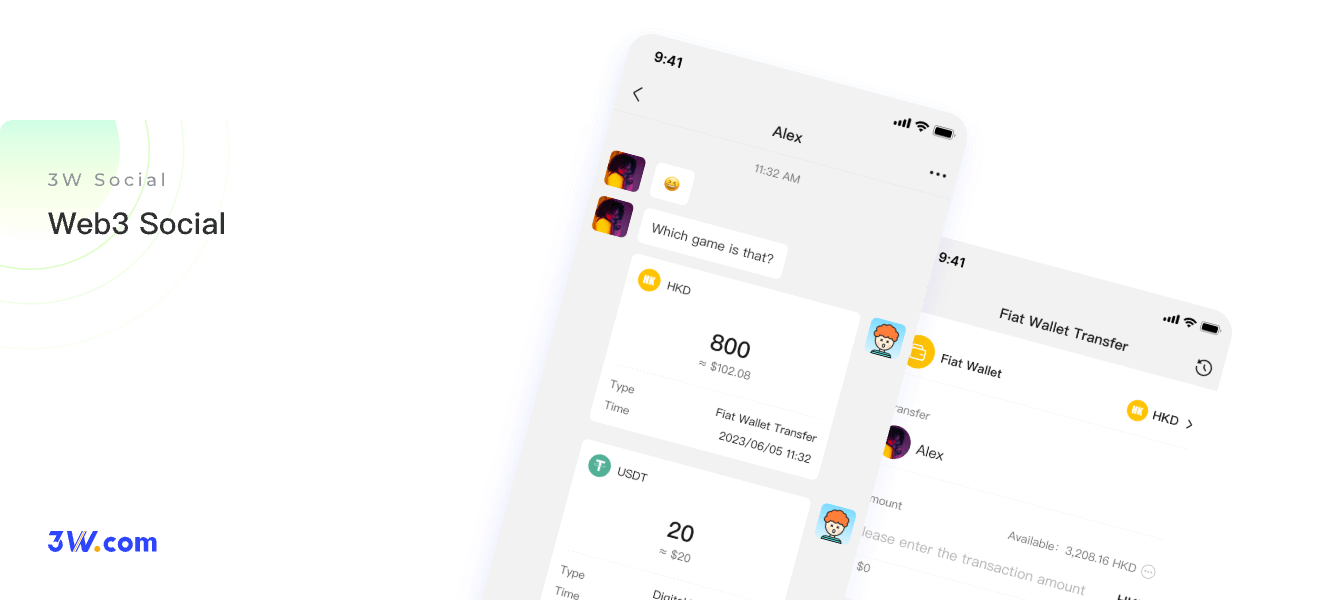

Innovation - Web 3 Empowerment

With the development and popularity of Web3, more and more traditional customers begin to try to use and configure related assets, while Web3 native customers also continue to emerge. In order to help the Home Office better meet customer needs and capture the newborn customer base, our technical experts have successively developed innovative modules such as Web3 Wallet, Web3 Social, Web3 DID, Web3 Transaction, NFT Incentive System, DAO Organisational marketing and other innovative modules, and can seamlessly integrate these modules into our overall Jiaoban system for customers to use on-demand.