-

Core business functions

-

Features

trade

On-site business: Connect with broker trading systems to achieve multi-market trading and market quotation reception;

OTC business: import or interface to obtain OTC data and liquidity;

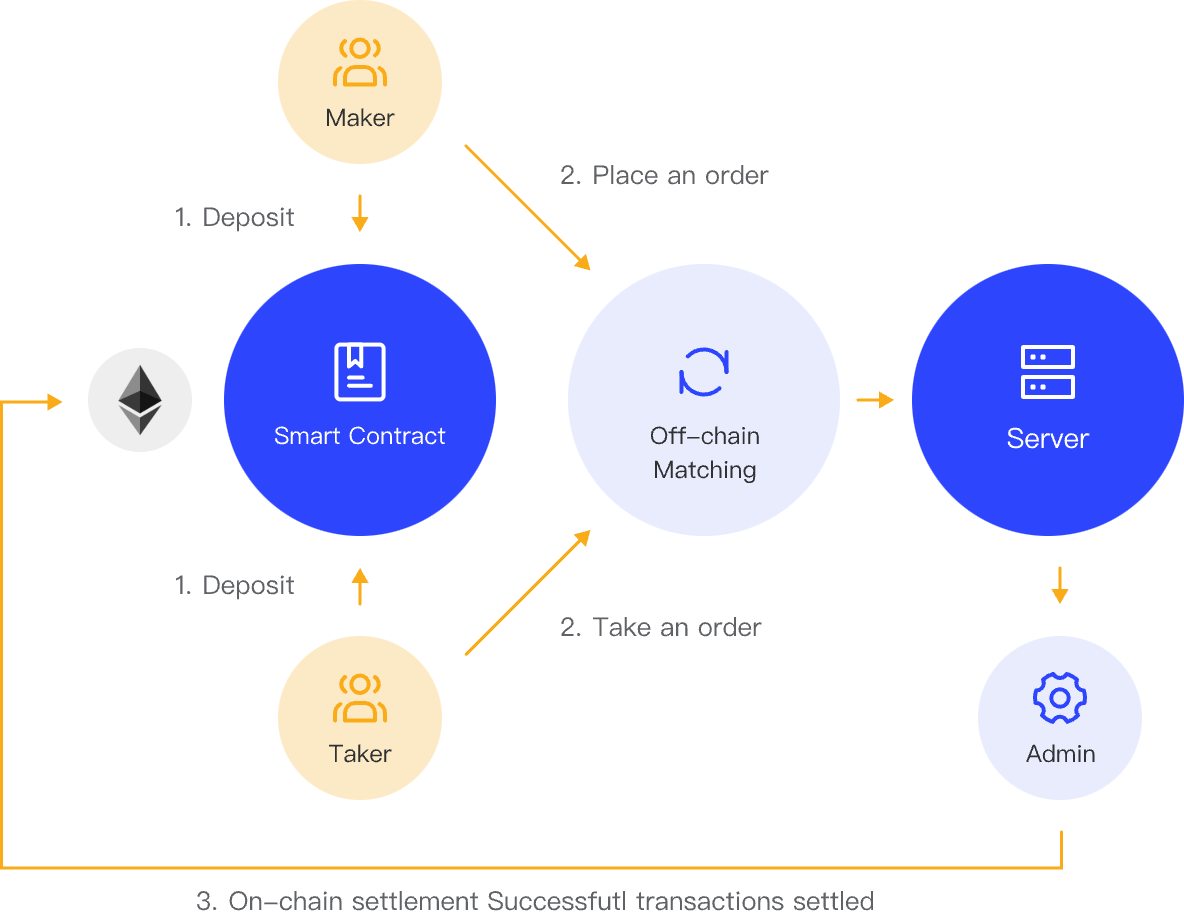

Web3 business: Layer 2, smart contracts, Web3 wallet...

Risk Control

Intraday risk monitoring: pre-event risk control, event risk control, and post-event risk control;

OTC business: import or interface to obtain OTC data and liquidity;

Intraday risk control indicator parameters: compliance risk control indicators, management risk control indicators.

Settlement

Multi-market capital account management;

Visualized multi-asset unit management;

Settlement in asset unit dimension and issue settlement report.

Multiple markets integrated into one system for trading and settlement

Global: Connected to 30+ countries, 150+ exchanges, 65,000+ trading varieties, and supports MT5 trading system;

"Web2 + Web3": The only product that provides B-side financial partners with a complete end-to-end hybrid finance (HyFi) solution, connecting traditional finance (TradFi) and on-chain decentralized finance (DeFi)

Powerful compliance and risk control management functions

Covers all investment tools, including global stocks, futures, options, bonds, funds, insurance, DeFi perpetual contracts, synthetic assets and other trading categories;

Compliance: Account group self-transaction, frequent withdrawals of large amounts, abnormal order prices, account position limit, single maximum order volume limit function, support transaction workflow management;

Risk control: manage products before, during and after the event, and customize multi-level risks in account groups, capital accounts and sub-accounts. Risk control can choose to only give warnings or directly limit transactions;

Supports warehouse division logic based on various management purposes and adapts to the requirements of various traders.